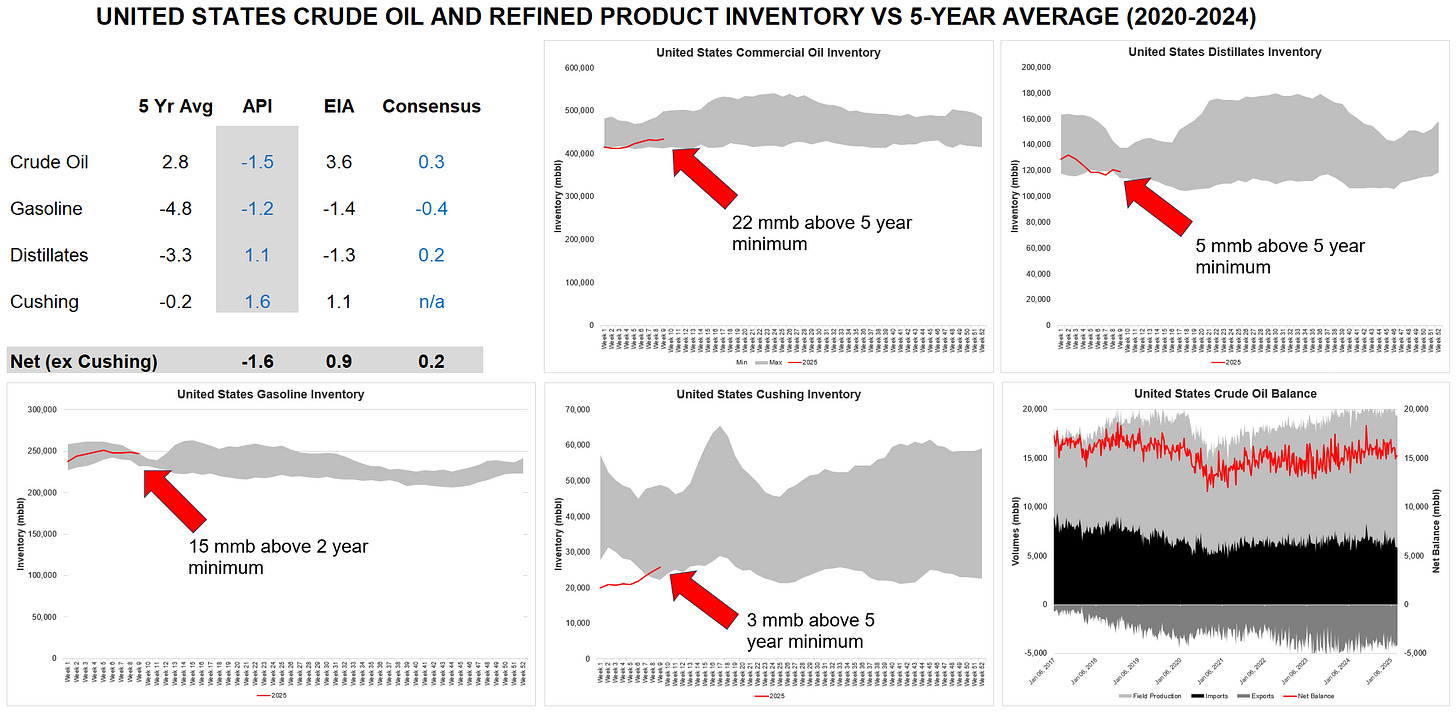

The latest data from the EIA is out and was neutral in comparison to expectations but slightly negative when it comes to the API data that was released yesterday. One data point that I think people will continue to remain focused on is the level of gasoline inventories for this time of year, which is now at 5 year highs.

In terms of pricing response, prices continue their downward grind since this data was released.

The far bigger factors right now are a) which direction Trump and his tariffs go (it feels like a which way / choose your own adventure book) and b) the calculus that goes behind OPEC+ returning curtailed production (2.2mmbpd) to the market through 2026, starting in April. Part of the OPEC decision is driven by continued over production by members and ongoing cheating, which some estimate at up to 800mbpd. The question is how much can the market absorb, especially in light of Trump as his tarrifpalooza. Based on pricing dynamics over just the past week, one could argue there is not much room for extra oil production right now.